As with many students, college is the first time you venture into the real world and start to make big life decisions on your own. From moving into your first apartment to getting your first job to learning to manage your credit, college is full of new experiences and learning opportunities. Unfortunately, many college students get into financial binds and rack up debt because they’re not entirely informed on how credit and debt work.

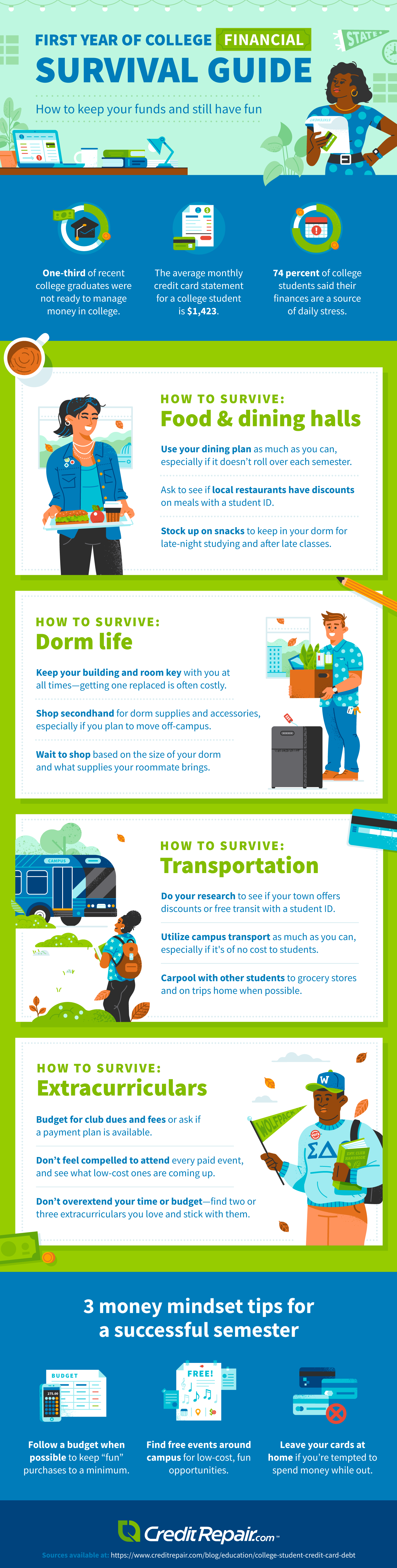

Many college students decide to sign up for credit cards because they want to start building credit, need help with the day-to-day expenses of being a college student, or want to use it for emergency expenses. Sallie Mae also reports that 58% of college students signed up for their first credit card to build credit, 29% said getting a credit card makes it easier to order things online, and 25% were interested in earning credit card rewards. Though building credit is an important part of adulthood, it can also become a burden if you’re unable to keep up with your debt. A survey from College Finance found that nearly one-third of recent college graduates said they were unprepared to handle finances while in college. To avoid going into debt and ensure you have a financially successful college experience, here are a few tips to remember starting freshman year.

1. Follow a budget

Sticking to a budget doesn’t mean you have to ditch fun purchases, but try to keep them to a minimum. Start by adding up all your necessary expenses, then choose how you want to spend the rest of your money throughout the month. Decide on a set amount of money to save each month to keep you in the habit of saving early. This will help ensure you have some cash for emergency expenses should anything unexpected pop up.

2. Find free events and discounts

Most campuses offer fun and free events on campus—and who doesn’t like free stuff? This is a no-cost way to get out and have fun while saving some money. Aside from free events, many stores offer student discounts, so always be sure to ask what they offer and have your campus ID card ready!

3. Leave your credit card at home

If you have a habit of using your credit card when you go out, make it a habit to leave it at home. Try using cash or a debit card only, and make sure to stick to your budget to avoid racking up unnecessary debt. College is a time to learn and grow. It’s full of life lessons that will help pave the way for a successful future. Check out the visual guide below from CreditRepair.com to learn more about surviving your first year of college.

Infographic by CreditRepair.com

First year of college financial survival guide

In addition to the three key tips above, here are more specific tips for saving money on campus while still participating in everyday college life.

How to survive: Food & dining halls

- Use your dining plan as much as you can, especially if it doesn’t roll over each semester.

- Ask local restaurants about any discounts available on meals with a student ID.

- Stock up on snacks to keep in your dorm for late-night studying and after late classes.

How to survive: Dorm life

- Keep your building and room key with you at all times—getting one replaced is often costly.

- Shop secondhand for dorm supplies and accessories, especially if you plan to move off campus.

- Wait to shop based on the size of your dorm and what supplies your roommate brings.

How to survive: Transportation

- Do your research to see if your college town offers free transit or discounts with a student ID.

- Utilize campus transport as much as you can, especially if it’s of no cost to students.

- Carpool with other students to grocery stores and on trips home when possible.

How to survive: Extracurriculars

- Budget for club dues and fees or ask if a payment plan is available.

- Don’t feel compelled to attend every paid event, and always see what low-cost ones are coming up.

- Don’t overextend your time or budget—find two or three extracurriculars you love and stick with them.

Related: Understanding the Dangers and Benefits of Credit Cards in College

We hope these financial tips help you transition to college, save money, and have a great time—all while setting you up for a stable financial future. Make a budget, stick to it, and be smart in your financial purchases, and you’re sure to get along just fine. Good luck in college!

To help you plan a budget and stay organized, check out these Budgeting Basics and Spreadsheets for College Students.