This article originally appeared on TheCollegeInvestor.com.

Students need all the financial help they can get. That's why every college student (and college-bound high school senior) needs to fill out the Free Application for Federal Student Aid (FAFSA)! Even if you think you won’t qualify for aid or have enough money to pay for college, you should fill out the FAFSA to avoid missing out on any grants, scholarships, and low-cost financial aid options that may be available. Beyond grants and scholarships, filling out the FAFSA is what's required to get federal student loans. That's why you should continue to fill out the FAFSA every year you attend college.

Why should I fill out the FAFSA?

Many students and parents don’t fill out the FAFSA because they think federal grants are only available to families earning less than $50,000. The truth? You could qualify for other aid despite your or your family’s income. To qualify for grants, scholarships, and federal loans, you must fill out a FAFSA form. When some schools charge over $65,000 for tuition, need-based financial aid is even available to students from middle- and upper-middle-class income brackets.

If you don’t meet the requirements for need-based scholarships, colleges could award you merit-based awards instead, so it’s definitely worth taking the time to fill out the FAFSA. Once you do, you’ll automatically qualify for low-interest and forgivable federal student loans as well, which are the best kinds of loans. The FAFSA is also required to qualify a parent for a federal Parent PLUS Loan.

Related: The Most Important Things to Know About Upcoming FAFSA Changes

How to fill out the FAFSA

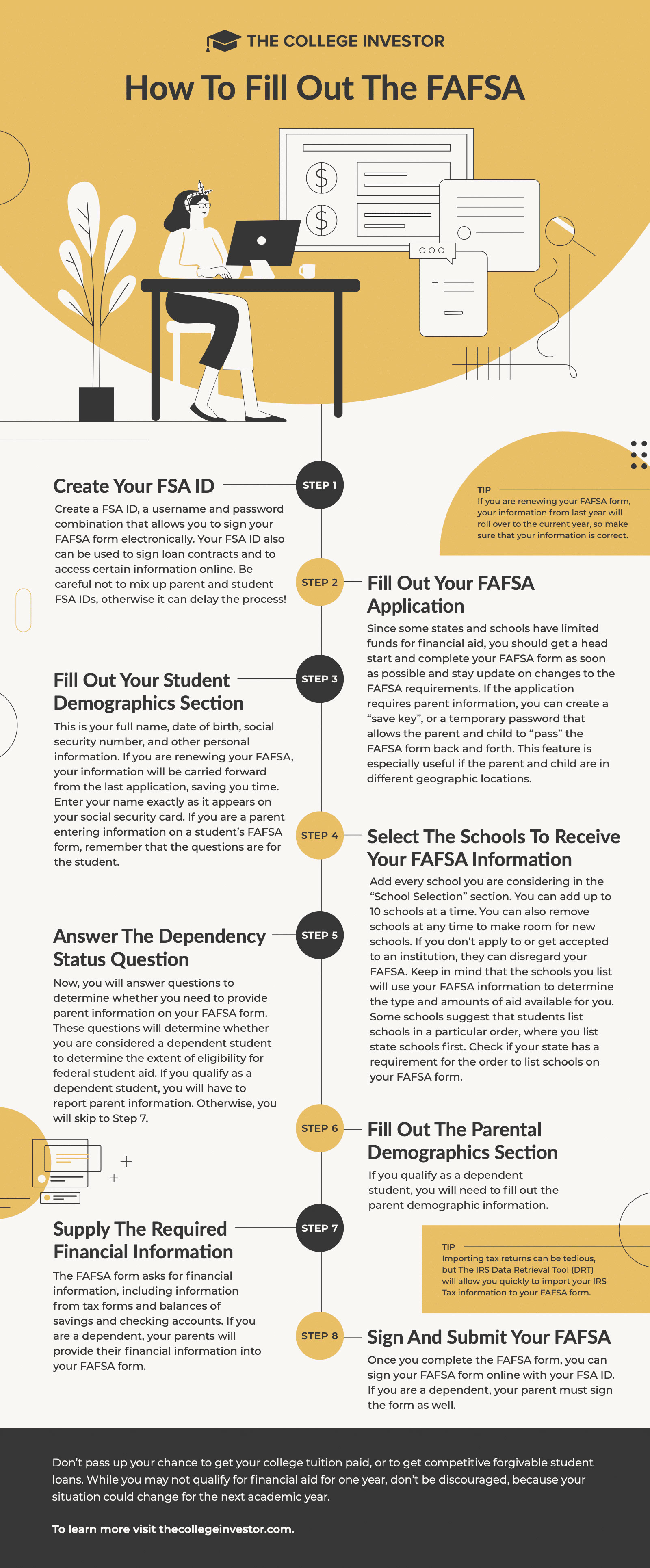

Whether you’re a student filling out a FAFSA or a parent or guardian of a student, this step-by-step guide will help you fill out the FAFSA the right way and qualify for maximum benefits. Remember, you must complete a new FAFSA for each upcoming school year.

Infographic by The College Investor

Gather basic personal information before you start

You should have the following information ready before you begin filling out your application. (You’ll also include your parents’ information if you are a dependent student.)

- Social Security number

- Driver’s license number or state-issued ID if you have one

- Alien Registration number if you are not a US citizen

- Federal tax information or tax returns

- Nontaxable income records

- Checking and savings account balances and investments, including stocks, bonds, and real estate aside from your primary residence

Step #1: Create your FSA ID

Create an FSA ID, a username and password combination that allows you to sign the FAFSA electronically. Your FSA ID can also be used to sign loan contracts and access certain information online.

- Students: If this is your first time filling out the FAFSA, you can use your newly created FSA ID to start filling it out. If you are renewing your FAFSA, you may need to wait a few days to get your account verified before using your FSA ID.

- Parents: If your student is required to report parent information on the FAFSA form, you need to create your own FSA ID in order to sign their FAFSA form online.

Important: Be careful not to mix up parent and student FSA IDs; it could delay the process! If you log in with your FSA ID, your personal information will be automatically populated in your application, which prevents errors if you accidentally enter your parent’s FSA ID instead of your own, or when the FSA ID does not match the information on your FAFSA form.

Related: Financial Transparency: The FAFSA, Your Student, and You

Step #2: Fill out your application

Since some states and schools have limited funds for financial aid, you should get a head start and complete your FAFSA as soon as possible while staying up-to-date on recent changes to FAFSA requirements. Students should enter their FSA ID username and password, then click “Next” to proceed with the form. Parents should select “Enter the student’s information,” then enter the student’s name, Social Security number, and date of birth. Then click “Next” to continue filling out the form.

Next, select the FAFSA form to fill out based on the time period you will be attending college. Check out the FAFSA deadlines here. If you’re attending college during both time periods, fill out a FAFSA form for the first period, wait until it processes, and then fill out the second form. If you are renewing your FAFSA form, your information from last year will roll over to the current year, so make sure that your information is correct. If your application requires parent information, you can create a “save key”—a temporary password that allows the parent and child to “pass” the FAFSA form back and forth. This feature is especially useful if a parent and child are in different geographic locations.

Step #3: Fill out your student section

This is your full name, date of birth, Social Security number, and other personal information. If you are renewing your FAFSA, your information will be carried forward from the last application period, saving you time. Enter your name exactly as it appears on your Social Security card.

If you are a parent entering information on a student’s FAFSA form, remember that the questions are for the student. If you’re unsure, check the banner on the left side to see whether you’re on the student or parent page. The FAFSA asks you a set of questions that will determine whether you are a dependent or independent student for federal student aid purposes. If you qualify as a dependent, you are required to report parent information in addition to your own information on your application.

Step #4: Select schools to receive your FAFSA

Add every school you’re considering in the “School Selection” section. You can add up to 20 schools at a time (changed from 10 with the recent FAFSA updates). You can also remove schools at any time to make room for new schools. If you don’t apply to or get accepted to an institution, they can disregard your FAFSA. Keep in mind that the schools you list will use your FAFSA information to determine the types and amounts of aid available for you. Some schools suggest that students list schools in a particular order, where you list state schools first. Check if your state has a requirement for the order to list schools on your FAFSA form.

What happens if you want to add schools later?

If you want to add schools later, you can log in to your FAFSA application, and then select the “Add/Update Schools” option. Remove some of the colleges listed on your FAFSA form, add the school codes for the new colleges, and submit the corrections for processing. Remember, it's always a rolling list of 20 schools.

Related: 5 Simple Mistakes to Avoid on the FAFSA

Step #5: Answer the dependency status question

Now you will answer questions to determine whether you need to provide parent information on your FAFSA form. These questions will determine whether you’re considered a dependent student to determine the extent of eligibility for federal student aid. If you qualify as a dependent student, you will have to report parent information, including financial info. Otherwise, you will skip to Step #7.

Step #6: Fill out the parental demographics section

If you qualify as a dependent student, you will need to fill out the parent demographic information in this section.

Step #7: Supply the required financial information

The FAFSA asks for financial information, including information from tax forms and balances of savings and checking accounts. This process is now a little less tedious since you're required to import your tax info from the IRS, saving some time and headaches. If you are a dependent, your parents will provide their financial information as well.

What info do I include in the financial section?

- Student income (including wages, taxable scholarships, and other sources of income)

- Student net worth (including value of brokerage accounts and real estate)

- Parent income (including wages, investment income, and more)

- Parent net worth (including the value of taxable brokerage accounts and real estate)

What info do I NOT include?

- Primary residence value

- Retirement account value (including IRA, 401k, etc.)

There are plenty of exceptions that you don't have to include; please speak to a professional if you're unsure.

Step #8: Sign and submit your FAFSA

Once you complete the FAFSA, you can sign your form online with your FSA ID. If you are a dependent, your parent must sign the form as well.

Related: The Best Advice and Resources for Filling Out the FAFSA

Don’t pass up your chance to get your college tuition paid for or competitive forgivable student loans. While you may not qualify for financial aid for one year, don’t be discouraged—your situation may change for the next academic year.

Another great way to lower your tuition bill is to pay with scholarships! Find over $7 billion in opportunities using our Scholarship Search tool, or check out our monthly scholarship listings to start your applications ASAP.